Custom Solutions

We offer flexibility and customisation to ensure you obtain a credit facility that meets your needs.

It can be hard for business owners to access the capital they need, when they need it.

We are on a mission to simplify commercial lending, with more common sense and less red tape. Follow these steps and obtain a loan with Skale.

Offer Security

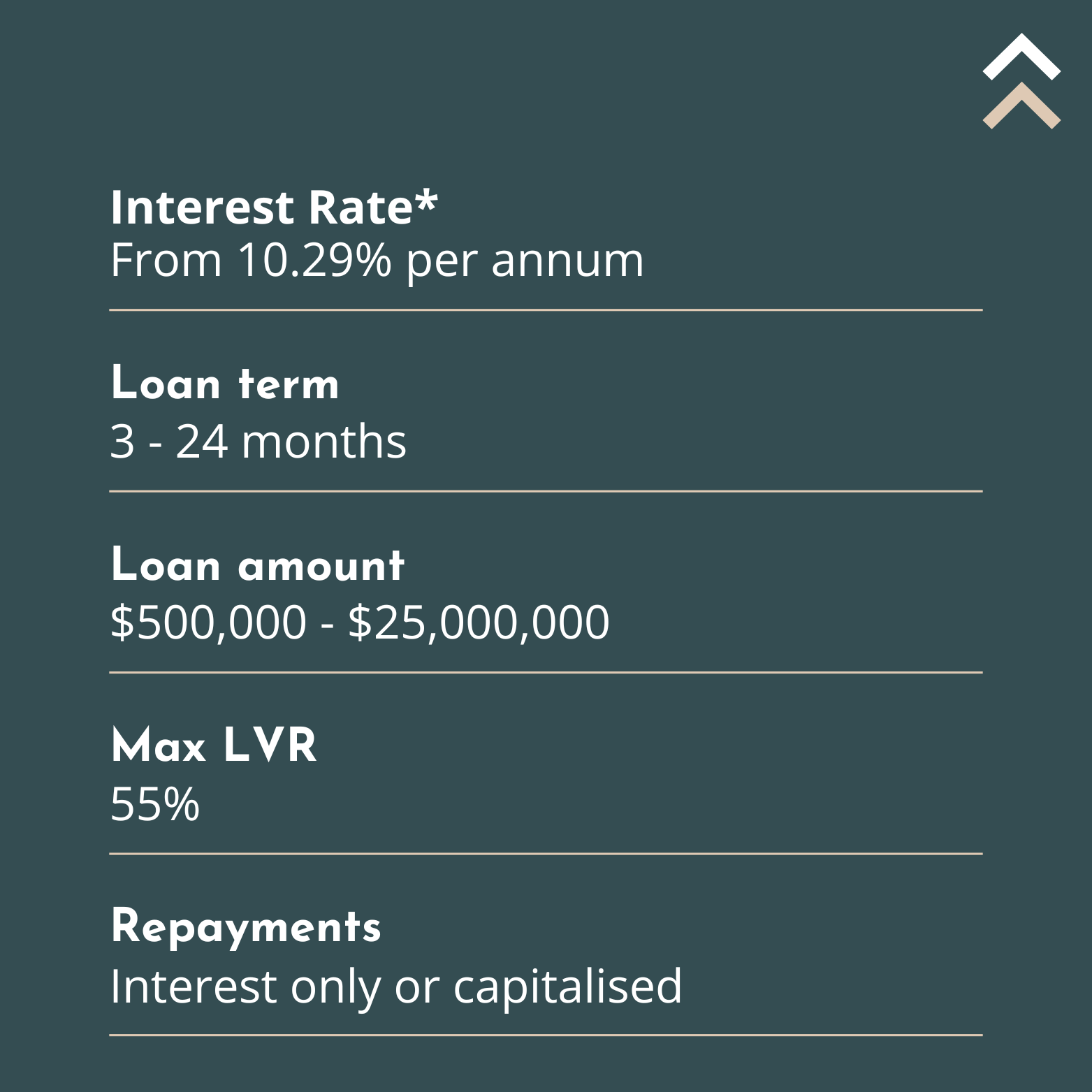

Our loan facilities must be secured by real estate assets. The asset type offered as collateral will dictate the interest rate and LVR that we can offer.

Choose your loan term

We offer loan terms starting from 3 months, up to 5 years. You choose the loan term that best suits your needs but don’t worry, you won’t be locked in, you can repay the loan any time.

Repayment type

We offer flexible repayment options that include either paying interest on a monthly basis, capitalising your interest on top of the loan advance or we can design your facility with a mix of both.

Exit Strategy

When seeking a short term-loan it is important to have a plan to be able to repay the debt. You may intend to refinance the loan or sell an asset. Evidence of your plan is required.

Loan Products.

FAQs

What types of borrowers do you lend to?

We lend to Australian Companies, Trusts and Self-Managed Super Funds where we determine that the purpose of our loan is wholly or predominantly for business use.

How are non-regulated loans different from traditional bank loans?

Non-regulated loans offer greater flexibility, faster approval processes, and are often available to borrowers who may not qualify for traditional bank loans due to unique circumstances or time constraints.

Is there a minimum or maximum loan amount?

We offer loans ranging from $500,000 to $50,000,000, with the potential for larger amounts for the right project and/or sponsors with the right profile.

What interest rates do you offer?

Our rates vary based on the security type, loan amount, and credit profile of the borrower/guarantors. We pride ourselves on being able to offer competitive rates that reflect the speed and flexibility of our services.

Do you consider borrowers with defaults, ATO debts, legal disputes or other credit impairment?

Yes, we can consider borrowers with credit impairment and other complex commercial or legal disputes. The security property(s) being offered typically dictate whether we can assist with a transaction.

How quickly can I get funded?

While every situation is unique, we aim to provide funding solutions within 5-7 business days from the time we receive your application.